Getty Images' Dilemma and Google's Advantage

In the last post, I wrote about Quora’s decision to lean into AI and the company’s (somewhat forced) business model transition. Given the rapid adoption of ChatGPT and Google’s decision to directly query Quora and other forums, Quora’s decision should probably be viewed both from the lens of a ‘brilliant strategic move by a founder-led company’ and a requirement to survive. The decision that Quora faces is not too dissimilar from the choices that other consumer internet companies will very soon have to make.

To borrow1 from Elad Gil, the market segments and companies that AI, especially generative AI, is best suited for today are markets where:

There are highly repetitive, highly paid tasks (code, marketing copy, images for websites etc)

Imperfect fidelity is fine, as you have a human in the loop who wants to review the items (which creates a nice feedback loop or future training set). Human in the loop is not necessary, but seems to be a common feature to date.

Workflow tools do not exist or are weak for the use case, so the AI features become a core and useful part of a broader workflow tool

Summarization or generation of text or images is useful for the product application - this is enabled in a high fidelity way by new AI tech in a way that did not exist before.

Mass media and content production fit squarely within this framework. For some businesses, generative AI could drastically make their business models better but in some cases, generative AI may be the beginning of the end.

To understand the spectrum of the outcomes, there are two interesting case studies worth analyzing – BuzzFeed and Getty Images.

Buzzfeed becomes more personalized

Buzzfeed announced to their staff (much to the staff’s chagrin) that the company will be incorporating generative AI to produce content, starting with “fun-entertainment” content e.g., quizzes. The goal is to serve more personalized content for its readers. This fits well within the company’s business model and value proposition to readers.

The company’s core business is advertising and eyeballs and the overarching goal is to drive traffic to the company’s various digital properties, which now include HuffPost and Complex. ~50% of the company’s revenues are from advertising and ~30% is from content creation for brands and publishing of sponsored content.

However, continuously producing content is expensive. And because Buzzfeed does not have much amortizable IP, the revenue growth has been driven by adding staff to produce more content to attract more eyeballs. Today, the cost of producing content represents 50% of revenues.

Now if you believe that good2 content drives additional traffic to the website, then content production is the key driver for the business’ growth. But again, content production in the U.S. is expensive especially relative to incremental new visitors it brings to the website. Furthermore, the company is effectively confined to serving the mainstream market because spinning up more niche content production arms does not move the needle relative to costs.

For Buzzfeed, generative AI is an ideal solution for the company’s bottleneck and scaling challenges3. Using generative AI, the company can cost effectively:

Increase the amount of content created → increasing the total ad inventory

Expand to new forms of content and audiences → increasing ad inventory and attracting new audience segments

The company can also elect to reduce the staff required for the existing user base and most likely will do all of the above using generative AI.

For a brand like Buzzfeed, which already has a captive audience and strong content engine, generative AI has the potential to deliver operating leverage that the company could never hope to achieve with its current model. While the idea might sound cruel and dystopian for those working at Buzzfeed today, it's not particularly new.

The Washington Post has been using AI to generate articles for a few years now

Buzzfeed’s opportunity to make generative AI a core part of the company’s strategy largely exists because of the company’s positioning as a high-volume and mass-market publication4. Publications such as the New Yorker or Scientific American likely cannot lean as aggressively into generative AI because the fidelity of content is likely more valued by its readers. We'll see if the company actually can execute this opportunity but it's clearly there in front of them.

Getty Images

Buzzfeed’s foil is Getty Images. Getty Images is a provider of stock images. Companies, agencies, and media organizations license these images from Getty and use them in their various publications, blogs, presentations, etc. The company sources its images from a network of photographers around the world and exclusive partnerships with sports leagues and media organizations.

Getty Images entered into the AI conversation recently by suing the creators of Stable Diffusion for training their models on Getty’s IP without a license – seems like a fair argument. Similar to Quora and using their “exclusive” IP, Getty is trying to position itself as a provider of training data for the next generation of models. Based on the company’s press release, it appears that the company has already been giving access to its library of images to companies to train their models.

From the Press Release

Getty Images believes artificial intelligence has the potential to stimulate creative endeavors. Accordingly, Getty Images provided licenses to leading technology innovators for purposes related to training artificial intelligence systems in a manner that respects personal and intellectual property rights. Stability AI did not seek any such license from Getty Images and instead, we believe, chose to ignore viable licensing options and long-standing legal protections in pursuit of their stand-alone commercial interests.

And from their lawsuit filing

In appropriate circumstances, and with safeguards for the rights and interests of its photographers and contributors and the subjects of the images in its collection, Getty Images also licenses the use of its visual assets and associated metadata in connection with the development of artificial intelligence and machine learning tools. Getty Images has licensed millions of suitable digital assets to leading technology innovators for a variety of purposes related to artificial intelligence and machine learning.

Here’s the challenge, the output of generative AI models such as Stable Fusion and Midjourney are (1) getting better, (2) stunning, and can be (scary) realistic. At the pace that these models are improving and the quantum of training of data they have available to them, it is more likely than not that in the future most stock images can be generated by AI or a designer with prompt engineering skills for a fraction of the cost.

Said more bluntly, by making this choice to become a training data vendor, Getty Images is more or less training the tool that commoditizes a large percentage of their IP for a large of their use cases. Here’s an overview of the end markets they serve:

The company does not provide a more granular breakout so let’s say that 30-40% of categories are at risk and that roughly equates to revenue5. And because this is a content licensing business model, every $1 price decrease drops straight to the company’s bottom line. The company's gross margins are ~70%, so pricing pressure on 30-40% of revenues likely equates to 60-70% of EBITDA at risk.

Now, there is one important difference between Quora and Getty Images that inhibits Getty from following in Quora’s footsteps. Getty has a large franchise that would have to be cannibalized for the promise of an uncertain tomorrow. The company generates ~$1B in revenue with ~30% EBITDA margins. Embracing generative AI head-on might mean

(1) Getty trains their own models and creates a Midjourney-type product for their customers

(2) Transform into a data vendor for model companies similar to Quora. But will the revenue opportunity be large enough to offset the losses on the core franchise?

Both options put Getty in a position where they’re risking a $300M profit-stream, to compete in an unknown market, for an unknown payoff and against more tech-savvy competitors. So Getty Images is effectively stuck in the middle. Preventing all companies from training on their models is moot because while the company’s images are premium, they are not the only source for images. So the company has chosen to become the short-term licensor of training data for generative AI companies. This is a doomed decision because in a few year’s Getty’s libraries will not be as important for the model training and refinement.

In contrast, Getty’s lower-tier competitor, Shutterstock has completely leaned into generative AI. So what gives? Again, the answer lies in the company’s business model, cost structure, and market positioning. Shutterstock focuses on selling to cost-sensitive customers for less than <$1 per image. On the other hand, Getty Images primarily sells to companies that are looking for high-quality images and charges >$100 per image. Shutterstock sources their images from the low-end of the market whereas Getty Images works with established photographers, sports leagues, etc. to source its content.

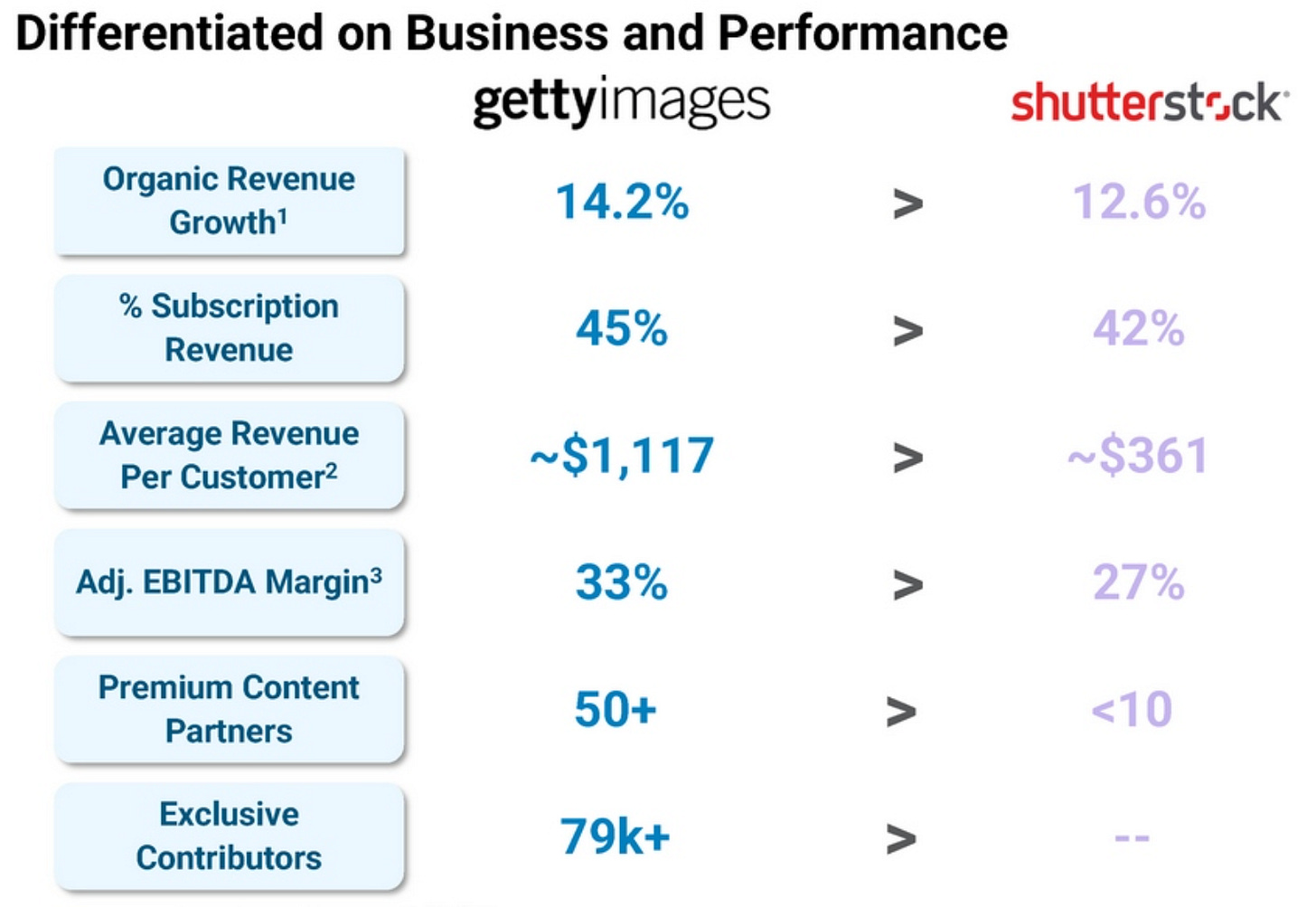

The difference is illustrated in the company’s metrics (price, margins, premium content).

By already being a low-cost vendor, Shutterstock is able to embrace this new technology that is reducing the cost of alternatives in the market i.e., commoditizing the market. Getty as the premium brand cannot unless they radically change the company. Shutterstock is also risking far less because its adoption of generative AI adds to the company’s core value proposition of providing cheap and easy-to-use images for its customers. As the premium vendor, Getty would have to position a drastically cheaper and likely equally compelling image/IP next to their premium content — somewhat of a doomest proposition.

Will some customers choose legacy Getty images? Absolutely – especially when the images are of marquee events. But will some customers trade down? Yes and even if 20% of customers trade down to the $10 or less type of generative AI images, ~30-40% of the company’s EBITDA evaporates.

The company’s options frankly seem limited6. Getty Images will not be the last company that is going to be in this messy position.

ICYMI…

In light of the Bing search release, I shared a few data points and thoughts about the uphill challenge Bing faces vs. Google because of Google’s massive distribution advantage.

I will do a deeper analysis of Bing-Microsoft in the future but I thought the Microsoft roadmap from the event was interesting. Canva and Gong are clearly in the company’s cross-hairs. As I wrote in the last post, if you’re a company like Gong and you’ve built a business around your AI/ML capabilities, you have many targets on your back – startups and big tech companies are coming armed with these widely available models.

Steal

Squishy term, I know.

Primarily for non-journalism use cases.

Again excludes the company’s journalism content, which is increasingly becoming less important for the company.

Or another way to look at it, the company’s revenue from non-exclusive content is at risk and non-exclusive content represents ~40% of revenues.

Before some value investor comments, yes, I’m aware the debt paydown and return shareholders could still make this a good investment.

GETY and SSTK's equity values are roughly the same as of today (+$500m), should make for easy reference in a couple years for how it plays out

Cheap to practically free, AI digital generative models will start to eat Getty Image's lunch.