Welcome to Tidal Wave, an investment and research newsletter about software, internet, and media businesses. Please subscribe so I can meet Matt Levine one day.

Given this is an investment-focused post, a quick disclaimer: this is not investment advice, and the author holds positions in the securities discussed.

As covered in a recent thread, Workday was founded by Dave Duffield and Aneel Bhsuri in 2005 after their previous company, PeopleSoft, was acquired by Oracle in a hostile takeover. Since then, Workday, now led by Bhsuri, has effectively been re-creating a cloud-native version of PeopleSoft. The company's ability to start with a clean slate afforded them a number of product and architectural advantages that have enabled the company to build a best-of-breed ERP for the services industry.

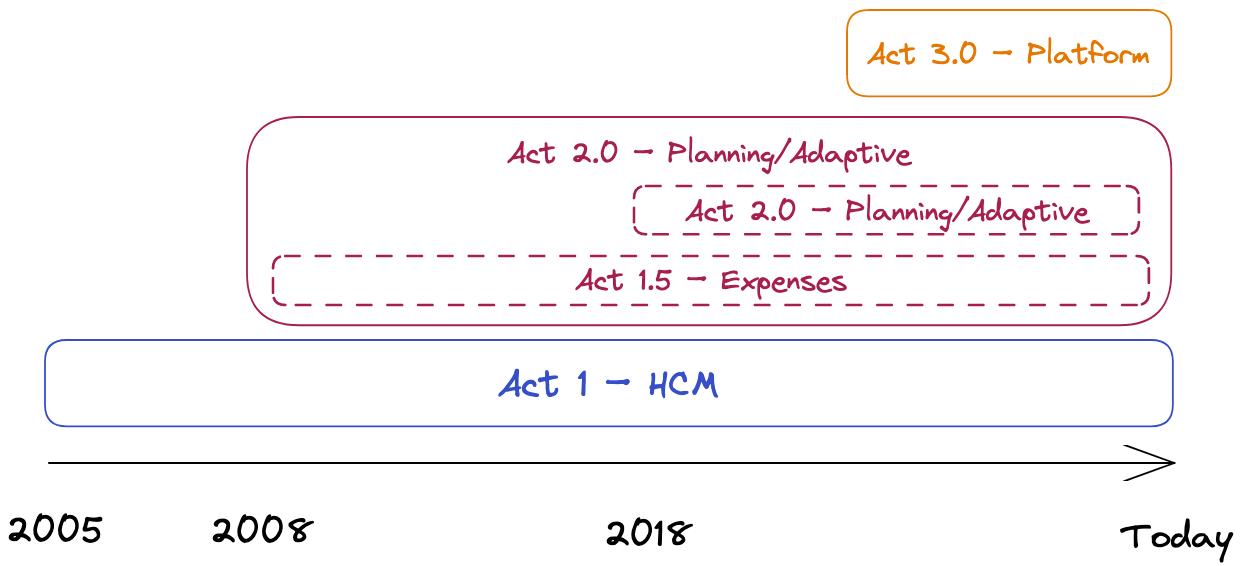

Their Act 1 was to leverage the cloud advantage to dominate the HCM market. Act 2 was to expand beyond HCM to Financials and build the leading ERP for the services industry. While the company is still in the middle innings of Act 1 and early innings of Act 2, Workday’s Act 3 (Platform/Extend) is beginning to take shape. The combination of those three levers and the company’s investments in the channel provides a meaningful runway for 20%+ top-line growth for the next 5+ years.

This post is a deep dive into the company’s product story and my investment case for the company, which current levels ($190/share), I believe, represent an attractive risk/reward for a 3-5 year hold.

Best of Breed Platform and a SOR Case Study

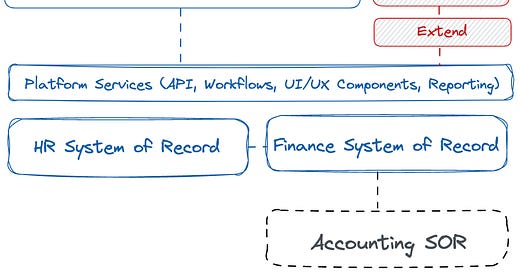

Workday has 1.5 systems of records (“SORs”): (a) Human Capital Management (“HCM”) and (b) Financial Planning and Management. The company started with HCM, payroll, and a basic financials suite. Overtime, via product development and some M&A, the company has expanded to build the ERP for the services industry. The core platform can be broken down into three components:

Human Capital Management: products help companies and HR leaders manage their workforce through their entire lifecycle. Lifecycle management means employers can use Workday to manage recruiting (e.g., Job Board), hiring (e.g., Applicant Tracking), onboarding, payroll, learning, and development. These are all extensions of Workday’s employee system of record.

Financials: products that help companies and CFOs manage all of their financial and account processes, which includes Planning (Adaptive Insights), close automation controls, AR/AP, and expense management. The core value proposition for CFOs is that it enables them to get their teams out of spreadsheets and centralize all the relevant financial data in one place.

Platform Services: These are services and modules that support things like reporting, data management, and app building across both systems of record.

ERP for Services Industries

Workday is primarily focused on services industries, which include (but are not limited to) tech, media, financial services, retail and hospitality, education, and healthcare verticals. This focus is out of both necessity and choice.

Legacy ERP vendors (e.g., Oracle and SAP) are very strong in industries with high-degree of manufacturing complexity and direct costs1. While not technically impossible to build, capturing all the edge cases would have been expensive and requires a zero-defect approach. Additionally, the services industries were faster to move to the cloud, which of course, is the target market for Workday.

Finally and most importantly, in the services industries, human capital management is often the most acute pain point for the C-Suite. For these companies, the ability to effectively recruit, onboard, manage, and develop their employees is a strategic priority. Oracle and SAP have been slower to develop modern and cloud-native HCM suites. And even though the companies have built HCM suites, they have failed to compete effectively with Workday’s more modern platform and modules2.

The net result is that Workday has consistently taken share across the board.

Workday has 20% of the Cloud ERP Market (+15 percentage points since FY ‘16)

50%+ penetration in Fortune 500 (+20 percentage points since FY ‘17)

25%+ penetration in Global 2000 (19 percentage points since FY ‘15)

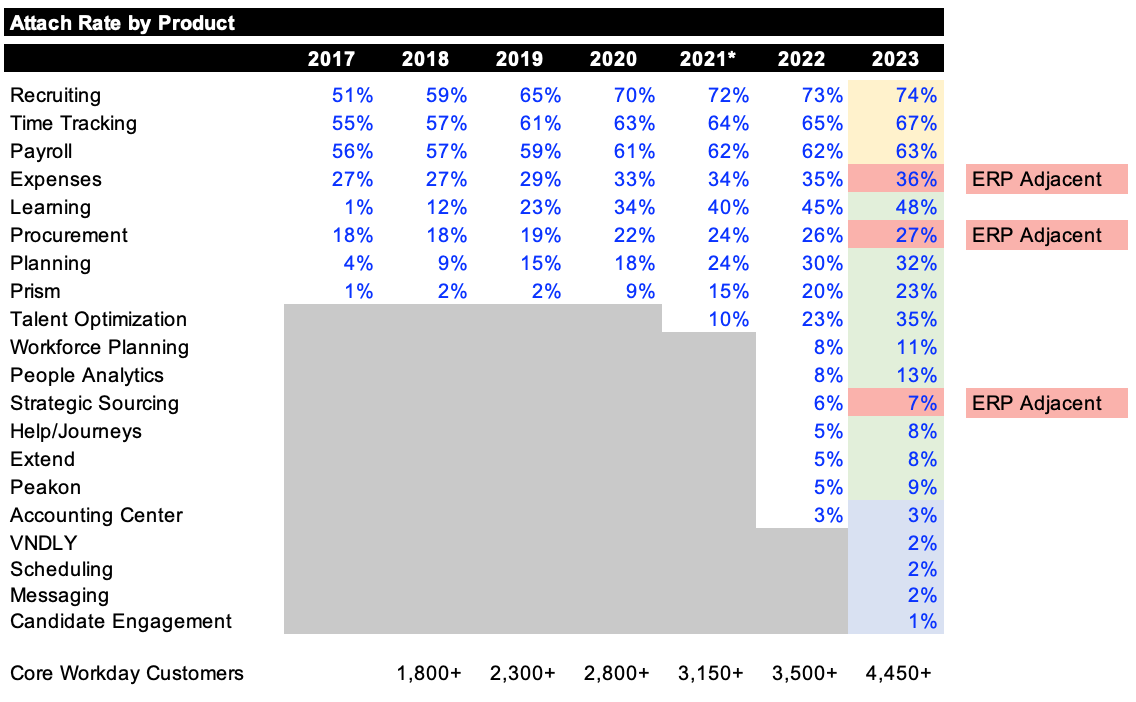

In addition to taking market share and winning new customers, Workday has consistently demonstrated its ability to launch new products that neatly fit the needs of the services industry.

Sustained Product Innovation Around Core SOR

Workday’s ability to continuously expand its product suite and consistently attach new products demonstrates both the company’s R&D capabilities and the power of owning the core system of record. The 1.5 SORs that Workday owns are HCM and Financials.

I consider Financials to be “0.5” of the “1.5 system of record” mentioned above because control over the financial system of record is a bit murky. Workday sits on top of the accounting system of record — general ledger (e.g., Netsuite). The general ledgers are typically controlled by traditional ERP vendors such as Oracle, SAP, Sage, etc. Many of the traditional ERP vendors, especially Oracle and SAP, have comparable solutions that compete directly with Workday’s Financials Modules. Moreover, because Workday does not own the SOR, the company has to compete directly with other 3rd vendors on equal footing.

You can see the impact of this competitive dynamic on the product attach rate numbers below. Modules such as expense and procurement have effectively hit a wall with regard to attach rate.

As I mentioned in a previous post, this can be a treacherous place to be if you’re an application software vendor. This is why Workday is investing in solutions such as Close Automation, Accounting Center, and Prism. Close Automation and Accounting Center are designed to be systems of engagement around the general ledger. And, Prism allows Workday customers to aggregate all the ancillary data that does not make it into the GL (e.g., “How many SKUs of xyz products did we sell?”).

These modules are designed to make Workday the core system of engagement for the “Office of the CFO” and effectively turn the GL into just a database for accounting.

There are potentially some upside drivers for Workday if the company can execute its efforts to commoditize the general ledger into simply a database – the main one being the ability to drive better attach rate on expense management and potentially treasury services down the line.

Promising early execution of “expansion” motion

Putting aside the nuances of SOR competitive dynamics, Workday has consistently demonstrated the ability to drive product penetration and upsell, especially at the “land” phase of a deal.

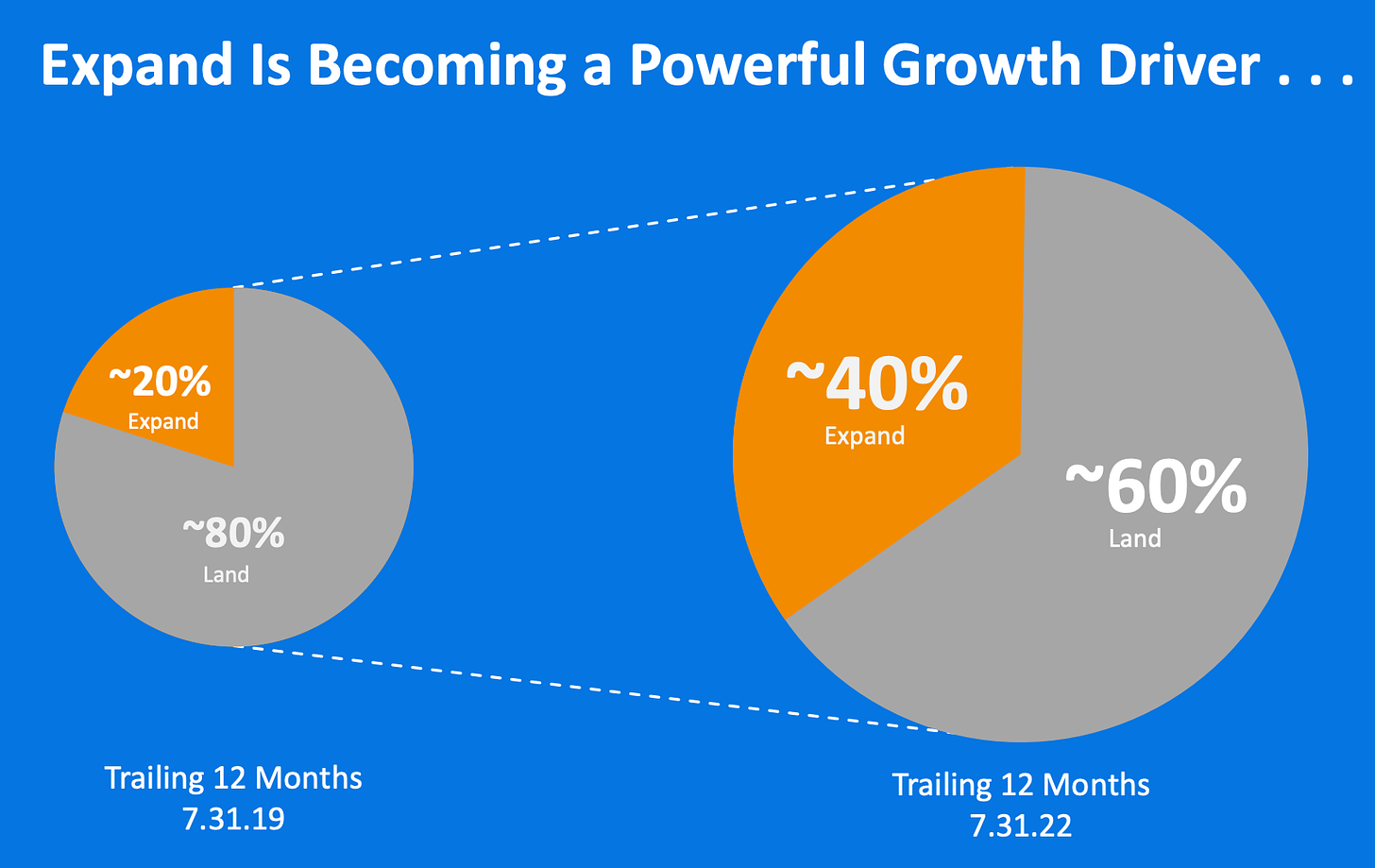

And Workday is just beginning to execute the “expansion” motion of its sales strategy. Historically only ~20% of net new ACVs were from existing customers, but that’s shifting…

…which is leading to ACV growth among the existing customer base of ~45%.

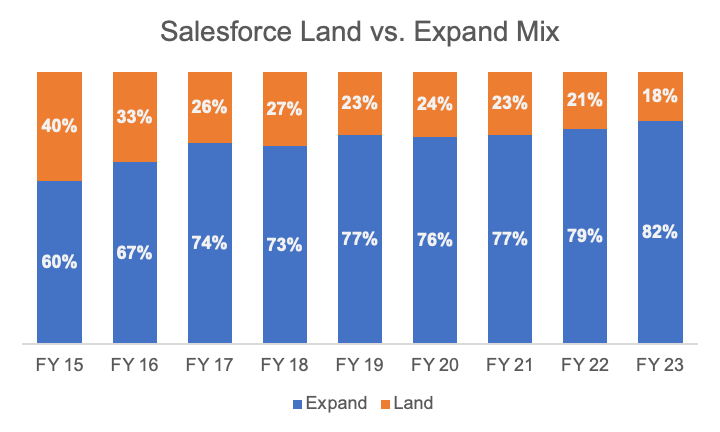

Workday’s evolution is natural and mirrors the other best-of-breed SaaS software companies – Salesforce and ServiceNow.

And Workday is relatively early in their journey in terms of driving the upsell motion.

Co-CEO Carl Eschenbach at MS Conference

But I actually think there are some things we can do, and we are in the process right now of looking at our go-to-market strategy, and we're going to modify some things. We're going to sell differently.

An example is something you talked about, typically, at Workday, when a renewal would come up, that's when we'd add new products. Now when a customer wants to add new products, even if it's midstream of a contract, we'll open it up, restructure it, add to new products, and then we'll co-term their existing footprint. So we're doing things like that.

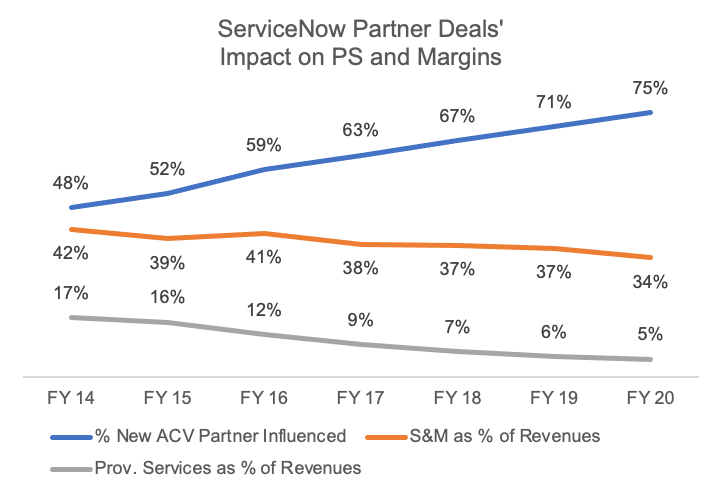

Over time, I expected that ~80% of Workday’s bookings come from the company’s installed base. Again, the impact of this should be that the company’s sales and marketing burden comes down. ServiceNow was able to take out 800 bps of sales and marketing costs. Obviously, Salesforce’s S&M leverage during the same period leaves much to be desired, but from a model perspective, as Workday transitions to more “expand,” the company should see meaningful leverage in the business. That “excess margin” will either be re-invested in the business to drive more growth or fall to the bottom line – either way, the pro forma FCF/share should continue to compound 25-30%+.

The “expansion” motion appears to be one of the main focus areas for the new Co-CEO Carl Eschenbach. In addition to driving more sales within the customer base, Eschenbach is focused on investing in the channel, which Workday historically has not prioritized.

Channel & Vertical Investments

One of the major gripes companies have with enterprise software, especially ERP software, is that the implementation cycles are long, and change management post-implementation can be painful. Software companies do not want to be in the business of implementation and customization, so usually, those teams are under-resourced or expensive. In addition, given the importance of ERP investments, many companies want advice from someone who’s seen multiple implementations before.

Channel partners (e.g., Accenture) and systems integrators help fill this void in the market. These companies often help the company choose the right vendor for their needs and guide them through the deployment and integration process.

Historically, Workday has underinvested in its channel relationships. Early on, for a good reason, they had to compete with Oracle, which has its own in-house consulting team. But now that the company is going to be approaching $10B in revenues, the company needs to engage with these channel partners for two reasons: (1) it’ll help them reach more customers, especially in the mid-market, and (2) it’ll reduce the burden of having Workday manage these implementations.

Similarly, Workday has invested in vertical-specific SI relationships and products to help drive the adoption of the company’s financials products.

The benefit for Workday of the channel working are: (1) they’ll have to support fewer professional services mandates, which increases gross margins, and (2) higher deal velocity in the channel will lead to better S&M efficiency. For reference, here’s the evolution of ServiceNow’s S&M spend and Professional Services burden vs. the % of the company’s deals sold or influenced by channel partners.

We should expect a similar dynamic to play out with Workday, albeit with small margin uplift, given Workday’s S&M is only 27% of revenues vs. ServiceNow’s >40%. These go-to-market investments are effectively optimizations around the company’s core business, but Working is looking to expand itself even further with its Act 3, the platform services.

Transition to becoming a “Platform” and Developer Flywheel

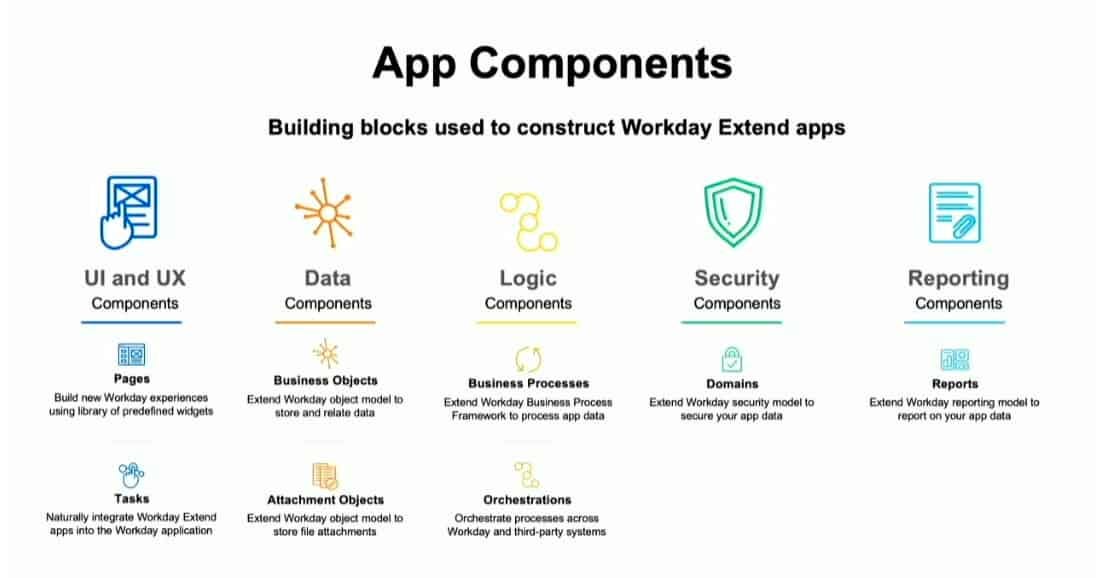

Workday can be abstracted into three components:

Systems of record

Platform Services: all the APIs, UI/UX components, reporting/querying functionality, etc.

Applications: the actual application with the business logic that end-users interact with.

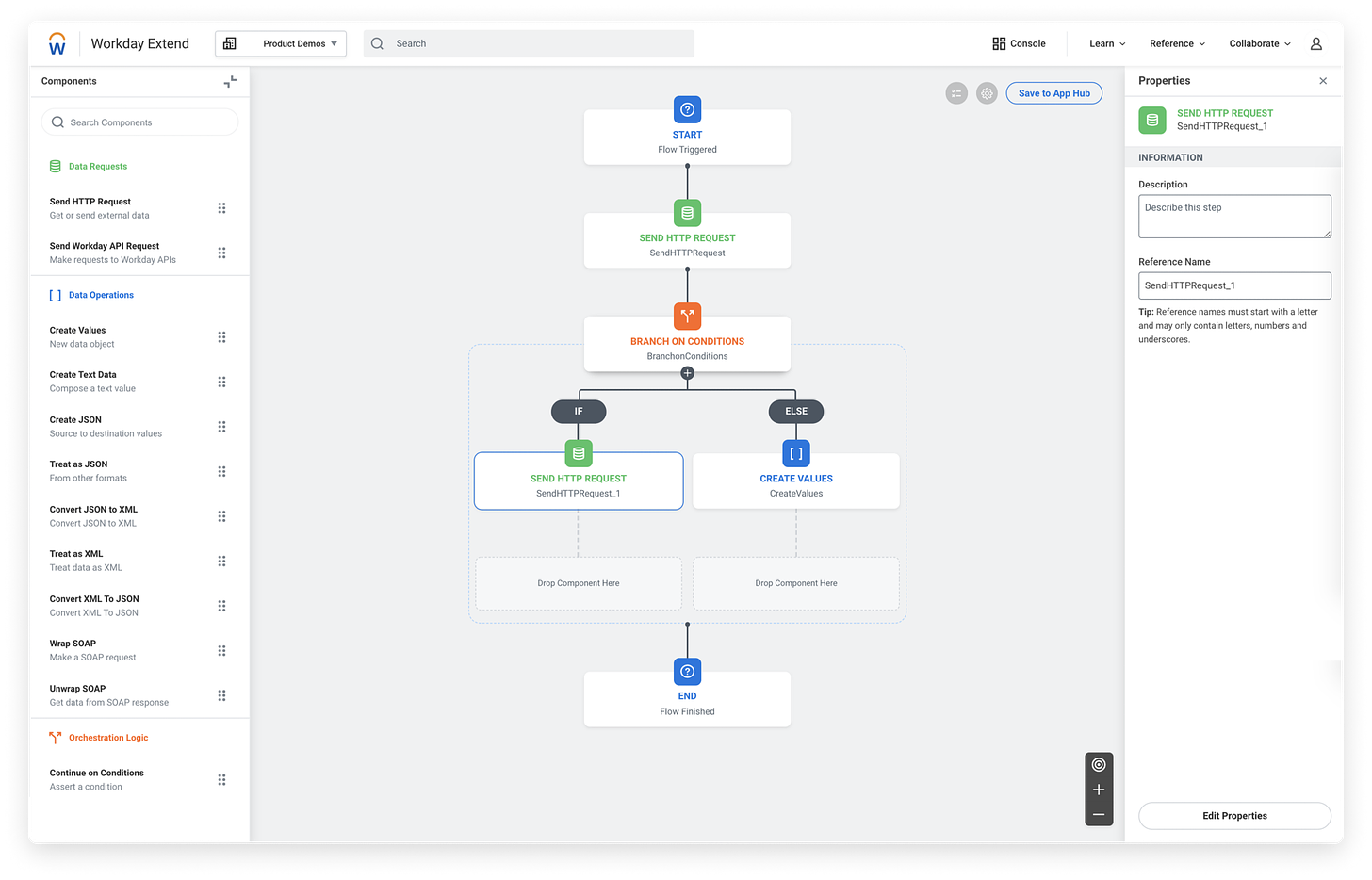

Workday Extend is the company’s app development platform that allows customers and 3rd parties to use Workday’s platform services to create their own 3rd party apps, workflows, and automation. Over the last five years, Workday has slowly been exposing these different components to customers and its partners.

These platforms are long-cycle investments because (1) exposing a large set of platform services in a controlled manner takes a long time, and (2) customers and channel partners have to invest a meaningful amount of time into learning the proprietary platform and tools. However, the investments are maturing. Workday hosted its 2nd DevCon last year. And there are now >3k Workday developers globally, and that number continues to grow.

It was interesting to note the following exchange at the most recent analyst day (which seems weird but also definitely scripted):

Workday 2022 Financial Analyst Day

Mark Murphy – JPMorgan Chase & Co

Great show. Thanks for having us here. So I wanted to ask you the first customer I bumped into today is with the Fortune 500 company, and I walked them to registration and then found out he works in the IT department of his company. So not HR, not financing. The company hadn't sent anyone from HR or finance to this conference.

So I'm just wondering how common is that trend where you see IT getting involved? And is that opening up a different type of -- kind of greasing the skids for broader and deeper discussions with some of these companies?

Aneel Bhusri Workday, Inc. – Co-Founder, Co-CEO & Chairman of the Board

Well, I'd say that since we started the company, we wanted to have a deeper relationship with IT. In many cases, some of our early customers were driven by IT, like Dave Smoley, Flextronics. But in the last 2 years, we made a concerted effort to really engage with IT, not just because they're involved with the projects, but because Extend is really an opportunity for us to work with them and have them put their resources into the projects with the extensions that they can build together. And so IT is coming, and now there's something that's really in it for them other than being somebody that watches out over the project.

Selling/marketing to IT is important because internal tooling and apps like the ones that Extend enable usually fall into their domain. The app development environment that Workday offers is relatively similar to the apps/workflows that the IT teams create using ServiceNow and Microsoft Power Automate.

While I do not think Workday intends to compete with ServiceNow, there are likely some ServiceNow HCM workflows that are likely subsumed by Extend.

Driving the adoption of Extend is important/beneficial to Workday for a few reasons:

Accretive to gross and (potentially) net dollar retention. The impact on gross retention is clear – companies building apps on Workday are going to make the platform stickier. Extend could also help drive net dollar retention (beyond Extend upsell) by driving wide usage across the enterprise.

Channel partner and industry verticals. Channel partners and SIs can leverage Extend to create solutions specific to their customer’s use cases and vertical-specific requirements. For the partners, this provides additional service revenues. For Workday, it helps the company address customer/vertical use cases not directly covered by their core platform. For customers, these solutions should help get to value faster and help with change management.

Workday Certified and Developer Community. Extend enables traditional developers and traditionally non-technical users to build their own apps and workflows. In effect, these users are electing to build skills and their careers around Workday’s platform. At scale, Workday’s developer ecosystem should have an impact similar to Salesforce’s Trailblazer program3.

Platform Flywheel. The combined impact of the aforementioned benefits is that at scale, Workday’s platform strategy should yield flywheel effects.

More Workday developers at companies, channel partners, and SIs leads to more apps built to address use cases and customer requirements that Workday does not already address. Over time, this should lead to More Workday Customers.

More 3rd Party Workday Apps also means that Workday’s R&D teams see more customer use cases that are not addressed. Once there are enough proof points, Workday can re-package those customer apps into out-of-box 1st party apps that it can sell to other customers. This is something that ServiceNow has done exceptionally well over the last five years.

More Workday Developers means that deployments and implementations are faster. Faster deployments mean (1) more customers because the time to value is lower and (2) higher velocity of deals.

Extend, combined with the investments that Workday is making on the channel partnership and developer community side, can be a powerful driver of the company’s sustained growth. The impact of this will show up in a few places: (1) the R&D burden relative to new product launches should decrease, (2) the S&M burden decreases as the velocity of deals increases, and/or (3) the savings from one and two are reinvested to help sustain the company’s revenue growth. The most likely outcome is somewhere between 1, 2, and 3.

Summary Investment Thesis

Investment Merits:

Workday is building the best-of-breed ERP for the services industry, and the company will continue taking share in the core market.

Workday is in the early innings of its expansion story. The company’s investments in the channel partnerships and customer base motion – will change the new bookings mix to 80/20 expansion/land over the next five years, which will provide meaningful S&M leverage.

Investments in the company’s platform services and ecosystem (developer, channel, and SIs) represent an Act 3 for Workday and will be a tailwind for the company to sustain 20%+ subscription revenue growth.

Near-Term Risks:

2023 is shaping to be a dismal year for software purchasing, and long-cycle investments such as Workday will likely be pushed out. Mid-market, which now represents ~50% of new ACVs (+30 percentage points from FY ‘20), will help mitigate the pullback in the enterprise. Additionally, the company has meaningful exposure to markets more resilient to cutbacks (e.g., hospitality, retail, and education).

Push into the channel will help with the company’s effective sales capacity and deal velocity. However, there is likely going to be some pressure on the headline billings figure. Additionally, Workday (like another enterprise SaaS co’s) has historically been willing to comp/give on pricing and billing terms during slower quarters to land longer-term deals, which will also pressure billings.

While the near-term risks create volatility, I’m bullish on the long-term revenue and margin targets. High-level model and valuation framework below:

Given the near-term risks, this is positioned as a 3-4% of the portfolio with room to double down if/when there’s a drawdown in the stock.

Fin. I’ll continue to track this one and post periodic updates about the business and any updates to the thesis.

If you’re finding this newsletter interesting, share it with a friend, and consider subscribing if you haven’t already.

Always feel free to drop me a line at ardacapital01@gmail.com if there’s anything you’d like to share or have questions about. Again, this is not investment advice, so do your own due diligence. I make no representation, warranty, or undertaking, express or implied, as to the accuracy, reliability, completeness, or reasonableness of the information contained in this report.

For example, SAP has Ariba, which allows its customers to source hard goods that go into their manufacturing processes.

For example, in the last two years, when the retail and hospitality industry was challenged with hiring, especially in a remote world, Workday rolled out a number of modern features, such as messaging and remote candidate engagement. Neither Oracle nor SAP has been able to offer the same degree of flexibility.

Trailblazer was a brilliant market tactic by Benioff because it has incentivized and continues to incentivize sales and marketing leaders to build their careers/skills around Salesforce’s platform and the Apex programming language. Whenever choosing new tools, the defacto for these users has always been Salesforce, given the economies of learning.

The companies that are going to 'win' when there is a slowdown in software spending are the companies with strong NRR. Looks like WDAY is absolutely in a position to do that. Fantastic article.

the attach rates for 2023, are they your estimates? otherwise, what's the source? thanks