Declining Returns in Software & Defensibility

And what's next for software investors and founders

The software market has had quite the heyday over the past ~15 years, and investors have fallen in love with the business model. Unfortunately, like all other investment trends and segments of excess returns, the software market has attracted a lot of investment capital and new entrants. Inevitably this has led to decreasing returns on capital, increasing capital intensity, and malinvestment on the part of both investors and companies.

Historically, building a software business capable of becoming a unicorn or going public required some insight or innovation (technical, GTM, data). But because of the availability of capital over the last decade, many founders and management teams have underinvested and/or ignored this requirement as they grew their businesses. In an era of cheap capital, it became too easy to hire a few additional reps, spend a little more on SEO and marketing to maintain healthy growth rates, and fend off investor concerns. As a result, many recent software unicorns have built businesses with thin or non-existent durability of growth or moats1. Many software businesses today have unit economics and capital efficiency that are meaningfully worse than what investors have come to expect from the business model.

As the fundraising and capital environment normalizes over the next few years, we should expect a new generation of hopefully more resilient software with better unit economics. Mostly, because the founders or investors will be required to because of capital constraints.

Lower barriers to entry and cost of capital

The SaaS market has grown meaningfully over the past 15 years. At the time of the GFC, the total value of SaaS companies was ~$50-100bn market cap, and now it is >$2tn. Part of that is a transition of legacy software businesses to the SaaS models (e.g., Adobe and Microsoft).

In addition to the broader software tailwinds, a few other factors have helped accelerate the growth of SaaS:

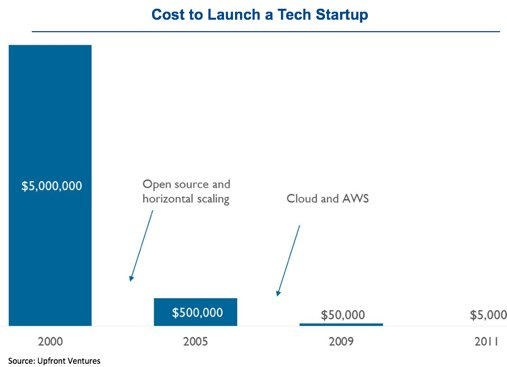

The cost to launch a SaaS startup has exponentially declined → driven by the growth of cloud vendors.

Reduced friction in selling and implementing software → driven by departmentalization of IT spending and willingness of companies to use cloud implementations.

Increase in venture and growth funding for SaaS co’s → driven by low-interest rates and public market demand/interest in software businesses.

The net impact is that barriers to launching a software business have decreased precipitously, and the cost of capital to finance these endeavors has decreased. As such, competition in many application software markets has increased, and as a result, the cost to scale a SaaS startup has meaningfully increased over the past decade. The two most prevalent areas are the cost of acquiring a customer and the cost of skilled tech employees (incl. developers).

Customer Acquisition Costs: Public longitudinal data is hard to find, and analyzing public company data is a bit noisy, but Profitwell’s data looks directional correct. Jason Lemkin has recently written about this from the perspective of the impact of excess VC funding on sales rep compensation, which I thought was poigant.

Cost to Hire: This topic has been covered ad-nauseam by many, but the cost to hire and retain high-skilled tech employees, which includes developers, sales leaders, and other execs, has gotten out of whack. Cash-rich tech companies (i.e., FANG) have been a cover driver of inflation. Startups and smaller tech companies have broadly tried to compete by paying more on equity. The impact is noticeable when you look at the SBC burden at software companies over time.

Declining returns on “vanilla” SaaS

So things have happened, the cost to scale has gone up, barriers to entry have gone down, and finally, these companies are increasingly priced to perfection. Investors have broadly fallen in love with the SaaS business model because these companies check a lot of the boxes that investors care about (recurring revenue, high-gross margins, sticky customer base, and high incremental margins2).

Naturally, this dynamic has led to excess capital, more competition, poor management discipline, and increasing capital intensity in the industry. The average lifetime burn multiple for SaaS businesses at IPO has steadily increased over the past few years34.

The businesses that have bucked the trend and will likely continue to buck the trend have been businesses that have typically innovated along some vector (product, GTM, or vertical focus).

Businesses that innovate on the product are rare in application software. And maintaining or extending that advantage is even more rare5. More often than not, product advantages are typically co-opted by an incumbent or other emergent vendors. So most software businesses fall into a bucket of "vanilla SaaS." These software segments are filled early on with multiple competitors with similar feature sets, rough product parity, and relatively low customer switching costs.

While it may not be an enduring framework, these vanilla SaaS businesses are typically not systems of record but are systems of intelligence, engagement, or productivity that sit around a system of record. Martech, productivity software, project management, and sales intelligence tools typically fall into this bucket of vanilla SaaS.

As a result of thin moats and the low cost of financing, vanilla SaaS markets have consumed a lot of capital. These businesses are hard for a variety of reasons (not exhaustive):

Pricing power is low, or price competition is high, given the competitive environment. In some instances, the alternatives might be free (i.e., spreadsheets), so the willingness to pay is even lower.

Companies need to consistently invest in expensive R&D to win new customers but not necessarily be able to flex on price to recoup R&D costs.

CACs are highly relative to the ACV/price, and GTM has to spend an inordinate amount of time educating the customer about the value of their product vs. alternatives.

Generally, the enterprise segment tends to be an area where this pattern bucks the trends. Often this is because the bar for establishing yourself in the enterprise is very high, but once a company does, the willingness to pay is high. The customer segments tend to gravitate towards an industry standard (i.e., copy each other).

So should we call it quits on vanilla software?

No. There are incredibly high-quality software businesses, but companies and investors need to understand what game they’re playing. If the business is going to sell vanilla SaaS, the business typically needs to innovate on the business or GTM model6. Businesses that have done this well have been Bill.com, Hubspot, and Atlassian.

For example, Bill.com’s differentiation has consistently been its ability to acquire new customers with brand awareness and its ecosystem/accounting channels. Emergent vendors (e.g., Ramp) may have better/flashier UI and marketing campaigns, but they struggle to replicate Bill.com’s ecosystem advantages.

And Hubspot has built a business around inbound/organic demand that converts and expands based on product excellence. The founders have historically been disciplined in ensuring the acquisition funnel was incredibly efficient because their business demanded it, i.e., it’s impossible to scale if you’re selling low ACV software with high CAC.

Interestingly, both companies were scaled during a time of higher interest rates, so they had to build businesses that could scale efficiently. The capital was too expensive for them not to. The counter-example to Hubspot is Freshworks, which is serving a similar end-market, but it’s hard to imagine that they’re going to be able to scale with their current sales efficiency metrics.

Bull-case is that the next generation of software business (i.e., ones being built today) and some companies willing to quickly course correct will hopefully have similar dynamics. However, the businesses that were built in the era of low-interest rates will have to massively re-adjust their economic models and go back to first principles to ensure that their unit economics actually makes sense.

There are a few sources of defensibility in application software:

Mission-critical system of record, e.g., payroll

Great product with strong organic demand and efficient GTM, e.g., Atlassian

Becoming an industry standard and how a swath of people do their job, e.g., Salesforce

Strong ecosystem dynamics, e.g., Bill.com

Discover an underserved segment or market early and quickly, e.g., Veeva7

The list is not meant to be exhaustive, but those have been the common patterns we’ve observed. For the next-generation software businesses, focusing on building some lasting advantage beyond “better product” that looks like one of these traits is going to be the determinant for if this business will win the market for the long-term because if the opportunity is attractive enough, competition will come.

Low churn rates do not a moat make.

Some will quibble with me on this point because software companies of late have failed to demonstrate the margin potential embedded in the business model, but this has historically been true when the companies have been managed by disciplined leaders.

The key exceptions were DataDog and Zoom, both of which IPO’d in 2019.

The confounding factor here is that businesses that were probably not considered attractive in the previous paradigm could IPO in a favorable IPO environment that smiled upon software businesses (e.g., AvidXchange).

It’s more likely that one finds these lasting product and technology advantages on the infrastructure side (e.g., database, observability, security).

We consider vertical SaaS in the family of GTM model innovation/insight

Veeva is an interesting case study because the uncertainty around their market size obviated attracting meaningful new competitors until after it was obvious the market was and after Veeva had won.

Great read, I wonder if your points on defensibility/GTM strategy would make vertical SaaS more appealing to growth equity investors. It seems like the focus for 2019-2021 was on investing in companies with massive TAM and betting on multiple expansion to drive returns, but now that markets are volatile and multiple expansion isn't a dependable driver for value creation, creating operating leverage and realizing scale will become more important. Vertical SaaS seems like a better place to play if your focus is seizing market share and realizing scale, even if at the cost of raw TAM numbers. Really appreciate these articles, super informative and helpful