Atlassian Part 1: The Everything for Everyone, Everywhere All at Once Platform

Welcome to Tidal Wave, an investment and research newsletter about software, internet, and media businesses.

Given this is an investment-focused post, a quick disclaimer: this is not investment advice, and the author holds positions in the securities discussed.

In his canonical book, The Mythical Man-Month, Fred Brooks argues that there are three types of tasks:

Unpartionable tasks: tasks where no matter how many people you add, the time to complete (“ToC”) does not decrease e.g., giving birth

Perfectly partitionable tasks: tasks where adding more people perfectly decreases the ToC e.g., wheat picking

Partitionable tasks with intercommunication: tasks that require two-way communication. In these tasks adding people beyond a certain point actually increases the ToC (pictured below).

Software development, and most knowledge work, generally falls into the fourth category. As more people are added to the process, at some point, the time it takes to complete the job grows rather than decreasing.

Collaboration tools are designed to solve this coordination problem by improving communication and knowledge diffusion across the organization1. Atlassian is one such company, the company’s mission “is to unleash the potential of every team”. With their beachhead products, Jira and Confluence, the company has built the leading collaboration software platform.

Early Pivot

But Atlassian was not always a software company. The founders Scott Farquhar and Mike Cannon-Brookes started working together in 2001. Originally, their business was selling one-off support and debugging services for customers of a Swedish software company (i.e., consulting). After ~1 year, they decided this was not a great business to be in.

Fortunately, by that time the founders had built a few internal tools to help them manage their consulting business:

Atlassian Support System - customers of software companies would use this tool to file support tickets that they wanted help fixing.

Wiki Tool - to help manage the documentation of the software they were supporting.

Email archiving - used to “archive” all the emails they were getting.

So they made a classic startup pivot - take a tool they’ve built for themselves and sell it to people that look like them, developers. The duo decided to commercialize their service desk tool, Atlassian Support System, and sell it to developers who would use the product to help manage their projects, file bugs, and track progress on projects. Oh, and they fortunately2 decided to rename the product, Jira.

And it was off to the races!

Theory of Constraints

Well not exactly. Unfortunately for the Farquhar and Brookes, they had two problems: (1) they were building a software startup after the dot-com bust and (2) they were in Australia and the venture ecosystem had just blown up and not in a good way.

But for us, VC wasn't an option. This is 2001, 2002. It’s the nuclear winter for tech. The world has just blown up. Australia had a couple of VC funds that emerged in 1999-2000 and invested in dStore and all these crazy businesses at absurd prices. All those funds completely blew up. They raised $100 million and returned $5 million — those kinds of numbers…

And so, we had to figure out another way. We used to go around and if we needed to sound smart in Silicon Valley circles we’d say, “Oh, we didn't really go down the VC funding route. We were customer-funded.” People would reply, “Okay, oh, wow. That's an interesting choice.”

And I'm like, “Okay, that worked.” (Source)

So the company, which at this point was just Mike and Scott, had a problem. They were building Jira but they did not have the capital to hire sales reps to sell their products. This funding constraint forced the founders to effectively innovate on the distribution model for their software.

We also didn't have any money, so we couldn't hire anybody. So the Atlassian business model came because we knew we needed to sell software somehow online, because we didn't have any salespeople, we couldn't afford to hire them, we didn't have any money, so it kind of had to sell itself. And that required us to do a lot of this tracking and modern things a long time ago….

And it really was a process on constraints. I really think if we had grown up in Silicon Valley and had venture capital around us, that we would have built a very different company that wouldn’t have been as disruptive as ours has been because we didn’t have venture capital…

And almost the thing we built in that model is actually almost less important than the fact that we changed the business model of how people adopted software to be much more consumer-like. (Source)

Atlassian’s founders were at the forefront of self-serve software purchasing. Prospective customers could go to Atlassian’s website, put down a credit card, download the product, and install it themselves within a few hours or a day.

The product had to be cheap. If it was too expensive, they would need sales reps to sell the product. Sales reps they did not have nor could afford to hire. If the product was going to be cheap (the first license was sold for $600) and you want to build a big business, you have to sell a lot of it. If you have to sell a lot of it, especially out of Australia in 2002, you have to sell the product globally. Global sales means 24/7 availability so naturally, the business model had to be internet-centric and self-serve.

So that’s what the founders did, they built a product that could be purchased on the internet with the swipe of credit and could be installed without external consultants/resellers. The strategy combined with early guerrilla marketing tactics worked.

They woke one morning in 2003 to find an order from American Airlines lying on the fax machine. According to company lore, they looked at each other and said, “Did you talk to them?”

“No, did you?”

“Holy shit! American Airlines saw Jira on our website and bought it just like that!”

The story is analogous to Salesforce, which used the cloud delivery model to go direct to their buyers at a time when most enterprise software companies had to rely on resellers and partners. The companies could not be more different but innovating on the delivery model and go-to-market (relative to the industry) is a theme we often see with technology upstarts. It’s a theme you see often with the “disruptors” in a given market, in many cases, it’s less about product innovation but rather taking advantage of an underused channel or distribution model. Another example is Dell, which used the direct-to-consumer model to disrupt the PC industry.

For Atlassian, beyond innovation, allowed the company to scale efficiently and helped build one of the most efficient GTM motions. Atlassian likes to emphasize this in their investor materials:

It’s pretty easy to find qualms in the chart and those quals are fair; the companies have different GTM motions, are at different stages of their life cycles, serve different types of customers, etc.

The better way to see the power of Atlassian is to compare the efficiency of its sales vs. its peers and at similar stages, which the table below shows.

Atlassian not only has the most efficient sales motion but maintains that efficiency as it scales. Additionally, the company is able to maintain that efficiency while maintaining the strongest growth durability among its peers. Arguably all of the companies in the table would fall into the category of “product-led growth” or “self-serve” and should have low CACs. The Gladwellian narrative would be that Atlassian’s constraints and lack of venture funding3 ultimately led the company to have a different DNA than their peers that were founded much later in better funding environments4.

The company’s sales strategy and efficiency are the foundation of the company’s flywheel5.

Like other great business models, the savings from an area of the business or line item can be used to fund excess investments in other areas, at least relative to peers.

The GTM is what enables Atlassian to invest in R&D aggressively and offer high-value products for low prices. The company was able to use the savings from their efficient S&M, the company could (1) re-invest in product development and (2) charge a lower price than their competitors.

Product Journey

Atlassian’s product investments (organic and inorganic) have allowed the company to consistently expand its product portfolio and the personas the company serves.

Atlassian started with Jira, which is a project management tool used for agile software development, allowing teams to track tasks, customize workflows, and monitor progress. A year later, the company launched Confluence. Confluence is a collaboration and document management tool that allows teams to create, organize, and share knowledge, information, and ideas in a centralized location.

Because of the inherently cross-functional nature of software development (and maintenance), both Jira and Confluence expanded beyond software teams to serve non-developers. Both Jira and Confluence are used by product managers, IT, designers, marketers, etc. And because IT had already implemented Jira and Confluence for the technical teams, the product was re-purposed to help non-technical teams (e.g., HR, finance, and legal) manage their workflows.

The combination of the two products would serve as the basis for the company’s growth for the two decades.

After Confluence, Atlassian launched or acquired a number of other products including Bitbucket (code deployment), Jira Service Management (ITSM), and Hipchat (messaging). The best way to frame the company’s portfolio is that Atlassian built different tools to address different parts of the DevOps workflow, which include maintenance of the software. I will not go into the different components of DevOps here but would suggest reading Gitlab’s overview.

There are a few unique aspects of Atlassian’s product strategy:

(1) Early to multi-product. The founders went multi-product in Year 2 of the company’s history, which was controversial at the time. The conventional (VC) wisdom is to focus on the core product until you have tens of millions of ARR and then expand to the second product. Most companies never make the leap.

(2) Served multiple personas. Really 1(b) but Atlassian was able to serve multiple personas early in the lifecycle of the company. The critical decision and why it worked was that they did not meaningfully change the product to serve the needs of the other personas. Persona drift is a slippery slope for startups, takes up a lot time, and more importantly, burns capital. Atlassian did not have to do that because their product was infinitely flexible and their customers (e.g., IT and devs) would customize the software to serve the needs of their internal teams. This would later become an area of weakness for Atlassian.

(3) Tuck-in acquisitions. Atlassian employed acquisitions effectively. The playbook seemingly was to acquire a leading developer tool to serve as a beachhead product into different parts of the DevOps workflow or in the case of Trello, the cloud deployment model.

The combination of self-serve GTM and product strategy has been the foundation of the company’s ability to expand consistently within its customer base.

What’s Eating Jira and Confluence Users?

But the company has not been infallible. For example, Atlassian acquired Hipchat in 2012. This was literally Slack before Slack. Companies like Uber were using Hipchat but defected to Slack as they scaled. The founders chalk the miss up to the fact they did not focus enough on the opportunity, in fact, they were practically giving Hipchat away. Also, the product wasn’t great – probably a relevant fact.

Arguably, the more concerning thing for Atlassian is the qualms modern companies have with their core collaboration suite (e.g., Jira and Confluence), which represents ~60% of the business. Jira and Confluence are flexible products with 20 years of features incorporated into the product. The product is built to be everything for everyone, everywhere all at once. An infinitely flexible tool.

There are advantages to this, such as allowing the company to serve other personas and (once implemented perfectly) can serve more types of companies. This has allowed the company to expand Jira into an “ITSM” platform to serve mid-market customers and compete with ServiceNow. It’s become a platform that other productivity tools companies build into.

There are also disadvantages to this. Jira and Confluence are very complex. If a company wants to implement Jira properly they typically need a trained Jira administrator that can scope the implementation perfectly, execute and handle the change management (i.e., make sure everyone follows the process). For many companies, it’s not worth it, or worse, they do it but other shadow tools pop up within the organization. This creates a steep learning curve for the people implementing the product but also for the organizations.

People have to be trained on how to implement and effectively enforce Jira/Confluence norms. This is not too dissimilar to the dynamic we see today with Salesforce’s Trailblazer Community6, there’s a generation and a half of IT managers, PMs, etc. that have grown up using and managing around Jira and Confluence.

The solution, ironically given the company’s self-serve roots, has been to leverage the agency/partner network to help companies implement the product for larger customers.

There’s even a vibrant community of Jira users that will tell you that they hate using Jira and Confluence.

Over time, that has created the (perception and) opportunity for companies to effectively unbundle or build more end-user-friendly versions of Atlassian. If you’re driving on the 101 towards SFO, you’ve no doubt seen this. The Marina Trench could likely be filled with the Billboards that have been used to advertise the latest venture-funded project management tool. This is exemplified by the growth in the number of listed competitors in the company’s 10-K.

The main way that these upstarts gained traction is by counter-positioning and marketing to “non-technical” teams. Today roughly 50% of Atlassian's seats are with “non-technical” teams i.e., marketing, finance, sales, H.R. For Asana et al, while expensive, the strategy has been paying off.

Recently, the most notable entrant is Notion, which unlike Asana et al is attacking the Confluence use case i.e., the company knowledge base. Today, most early-stage startups and founders default to Notion as the go-to Wiki. Finally, even though Atlassian lists Asana et al in the “Business Teams” category both Asana and Monday.com have made in-roads in serving the broader developer community (albeit limited) and startups like Linear are becoming increasingly popular with developers.

And of course, while excluded in the chart above, it’s hard to forget about Microsoft looming in the background.

Competition is clearly increasing in the market, especially for the non-developer use cases. How defensible Atlassian’s business and its long-term market share will be determined by a few things:

Their positioning as a “value” product. Compared to its newer peers, Atlassian’s offering is more feature rich and typically cheaper, which especially during downturns should allow the company to take share7.

There’s a bit “Trailblazer” aspect to Jira, because of the company’s relatively steep learning curve, Jira users and administrators are typically reluctant to learn a tool or system of project management simply for the UI/UX benefits.

Their ability to transition to the cloud effectively. One of the shortcomings with Atlassian’s product over the last ~10 years has been that their cloud product was simply not very user-friendly, in part due to some architectural differences between their platform and their peers8.

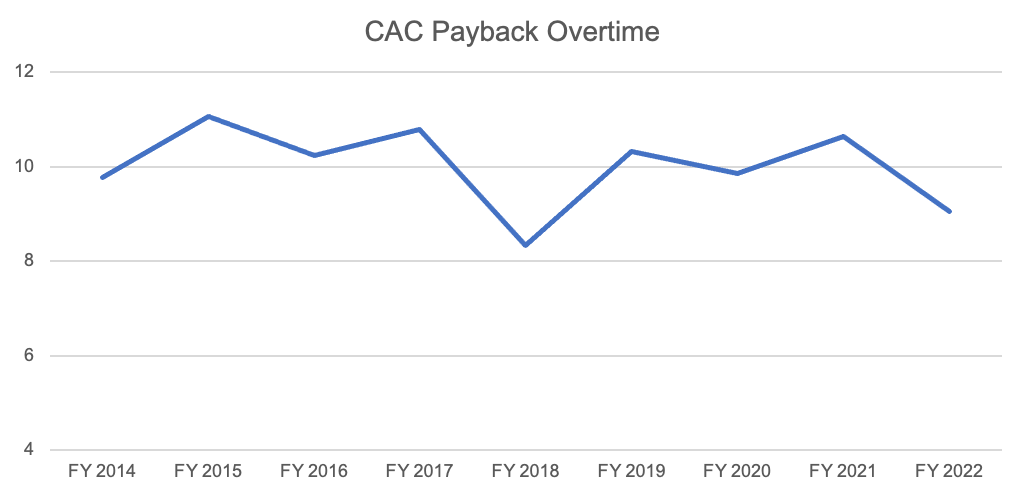

In software, the impact of new competition is usually felt in terms of a company’s ability to acquire new customers. Unless the software is not mission critical or a SOR, churn tends to be a very lagging indicator. In some ways, stickiness is table stakes. More often, the impact of competition is felt in two places: (1) new customer additions and the (2) cost of acquiring those customers. So far Atlassian’s CAC paybacks have been holding up well even with the move up-market.

New customer adds are a bit noisy for Atlassian given the number of products they have but a near-term headwind has been that their free customers are converting at a lower rate than historically. That’s likely due to the economic conditions as companies have pared back headcount growth.

Fortunately for Atlassian, its competitors are also faced with one major headwind: they have to show improving economics because of investors’ increasing focus on efficiency. The strategy that its collaboration software peers have leveraged over the last few years may not be available in a non-ZIRP environment because, well no one will want to fund that level of capital burn (with the exception of a billionaire ex-founder of the company formerly known as Facebook).

That’s one of the reasons Atlassian continues to roll out more features/products at prices meaningfully below the competitors. The founders said as much recently:

Turbulent markets provide an opportunity to shake up the leaderboards. We'll focus our investments to take share and strengthen our market position in this environment. We'll, of course, balance our continued investments with the overall growth of our business and be responsive to the macroeconomic conditions.

The flip side is that the company has fallen prey before to better UI/UX products like Notion that were able to improve their product (see: Hipchat).

What’s next for Atlassian?

To set up the company’s stage of growth and improve its defensibility, Atlassian has made a few bets: (1) transition fully to the cloud, (2) double down on ITSM (again) and (3) push into the enterprise.

The most important near-term goal for the company is to transition to the cloud delivery model and more importantly, reap the product expansion benefits of the cloud. The other two bets are really contingent on the cloud execution.

Today, only ~60% of the company’s revenues are delivered in the cloud model (up from ~40% two-and-a-half years ago and 25% at IPO). As the company continues to push (literally push in some cases) more of its customers to the cloud and those customer cohorts mature, the benefits should begin to show up in the durability of the company’s revenue growth, which is required for a business trading at ~10x NTM revenues.

In the next post, I’ll cover this cloud transition, its importance, the company’s ITSM bet, the recent product announcements (yes, there’s some AI), and of course, valuation.

Recommended Reading

If you are interested in learning more about software businesses, especially from an operator perspective, check out OnlyCFO - a newsletter about software, finance, and startups.

OnlyCFO writes incredibly thorough and entertaining pieces such as "How to Trick Investors & VCs - Understanding finance tricks in metrics and reporting” and “How to Read Balance Sheets - Software Edition”

Some would argue they make it worse.

Atlassian Support System does not shorten well.

They wound up raising money from Accel much later in the company’s life and it was only a secondary sale for them and their employees.

The exception is probably Hubspot, whose high CAC is likely more a reflection of their higher churn rates and end market than simple inefficiency.

Yes, the company builds great products, but I’ve also never met a company that aims to build bad products.

One of Benioff’s great marketing tricks was convincing his customers to build their careers around Salesforce.

For example, Atlassian’s Confluence product is ~20-30% cheaper than Notion and has enterprise-level reliability, which companies care about. Do not @ me with your Notion takes, I am a user of Notion and love the product but it is not enterprise-grade yet.

brilliant explainer, thanks for sharing